Intelligent Document Processing Platform Essentials

At many insurance companies, underwriters are stretched thin by a never-ending stream of submissions far exceeding their capacity to process. This bottleneck can lead to potentially profitable submissions left unreviewed and unquoted.

In other words, money is being left on the table.

The solution is more complex than hiring more staff. First, the scarcity of skilled experts in the workforce makes this approach impractical. And simply throwing more human expertise at an unwieldy set of documents won’t necessarily improve the quality of your document processing and analysis. That is why many organizations are investigating whether intelligent document processing (IDP) platforms are a viable strategy for bridging the processing gap.

In Commercial P&C and Specialty insurance, managing the diversity and complexity of documents submitted with underwriting applications is a critical challenge. These documents are often unstructured or nonstandard, which creates a significant hurdle in deploying a fully automated end-to-end IDP. There will always be exceptions that require human judgment. Therefore, maintaining underwriters' oversight is essential to ensure data quality and achieve rapid value realization from IDP initiatives.

P&C balance sheets can sometimes swing back and forth from profit to loss based on the consequences of even the most minor decisions. The best way to eliminate those mistakes isn’t to rely on AI or human expertise alone but to align them so you get the best of both analytical capabilities. This article explores how to best assess intelligent document processing platforms in the context of how they work best: with a Human in the Loop (HITL).

Is accuracy everything in IDP?

Not exactly. While accuracy is important, it's not the sole determinant of the business value of an IDP solution. Evaluating different IDP options based purely on accuracy metrics is insufficient. A comprehensive assessment requires a broader scorecard that goes beyond mere accuracy, incorporating criteria that guarantee the chosen solution can effectively:

- Tackle the unique challenges within your workflows

- Integrate seamlessly within your wider enterprise operations

- Be easy to manage and update

- And most importantly, contribute tangible business value.

5 IDP capabilities to assess when comparing solutions

You never want to buy technology just for the sake of it. Technology only delivers value when it works within the context of your business. It’s really all about enhancing your people and your processes. Within that context are five critical capabilities you must assess in each IDP service you consider.

1. Human in the Loop (HITL) design

Complete automation is undesirable for many underwriting workflows. IDP platforms are designed to keep humans in the loop and reduce risk by ensuring data accuracy even within highly contextual datasets, like underwriting applications. Unlike IDP approaches that strive for full automation, HITL design focuses on augmenting the human workforce rather than replacing it.

A HITL design aims to maintain full transparency and avoid introducing operational risks from “black box” AI decisions that impact whether your company underwrites a prospective customer. Human subject matter experts verify the correctness of data and put it in context before making underwriting decisions. That helps ensure that processes remain both efficient and error-free.

2. Universal extraction capability

Data extraction types and quality can vary widely among IDP platforms. In insurance, flexibility to handle a broad range of structured and unstructured document types is often a priority. Be sure to assess the range of data extraction capabilities of each IDP you consider.

You may want a platform that can easily process structured formats with little training or templating in many scenarios. But that alone often isn’t enough, and given their prevalence in insurance datasets, you will want your IDP capable of processing unstructured documents as well.

Machine Learning (ML) can enhance an IDP platform by offering contextual “understanding” of documents. ML algorithms sift through text to uncover semantic meaning, allowing the system to interpret a document’s context, structure, and how different pieces of information relate before your HITL subject matter experts even need to see it.

3. Rapid AI training and adaptability

In any industry, if the market is competitive, new technology needs to demonstrate rapid time to value. IDP platforms are no different. The long term is important, of course, but what can each IDP you consider do for you in the short term? If there’s no value in the short term, you’ll never get to that long term.

The flexibility of an IDP system that can adapt to new requirements can significantly enhance operational efficiency. And while adaptability in the initial setup is important, good IDPs also must be adaptable in how they are trained and retrained. A continuous learning process based on document types, structure, and context ensures that the system remains effective and accurate over time.

4. System integration

If you’re standing still, you’re falling behind. As businesses grow and evolve, out of necessity, so does their enterprise IT infrastructure. IDP technology needs to fit into the dynamic ecosystem of your other IT systems and processes. Evaluate each IDP system’s capability to integrate into that existing ecosystem and accommodate future growth.

Technology needs to work for you, not vice versa. The platform should be intuitively designed with underwriters and other insurance industry professionals in mind, making it straightforward to learn, utilize, and maintain. This accessibility ensures teams can operate the system effectively without extensive technical training.

And as your business and the industry evolve, so will your document processing needs. Your chosen IDP platform must be capable of processing increasing volumes of documents, and different types of documents, and scaling them in response to unforeseen market and social conditions without sacrificing performance or accuracy.

5. Auditability & explainability

Auditability refers to the ability to track and review AI systems' decision-making process, providing a clear record of actions and outcomes. Explainability, on the other hand, involves the capacity of these systems to present their processes and decisions in understandable terms, allowing users to grasp how conclusions were reached.

In insurance IDP systems, auditability and explainability help business leadership understand how underwriting decisions are made and provide data points to explain how or why different policies were written or passed on. Specifically, in insurance, complying with model risk management requirements is essential. Auditability plays a key role here, enabling organizations to demonstrate that their AI systems operate within the bounds of regulatory expectations and industry standards. This transparency is crucial not only for compliance but also for building trust with stakeholders and customers.

Forge a new path by leveraging SortSpoke

Sortspoke is the premier platform for managing complex unstructured insurance data. It can manage simple documents out of the box, and when paired with human experts, it can process unstructured documents up to five times faster than traditional methods. Our support extends to various formats, including MS Office files, images, tables, emails, PDFs, handwritten notes, and even password-protected documents, catering to a global clientele with capabilities in any language that utilizes the Latin alphabet.

These comprehensive data processing capabilities provide unmatched efficiency and support to underwriters. Through our innovative solutions, we're not just processing data. We're transforming the landscape of insurance underwriting for the better.

MORE >

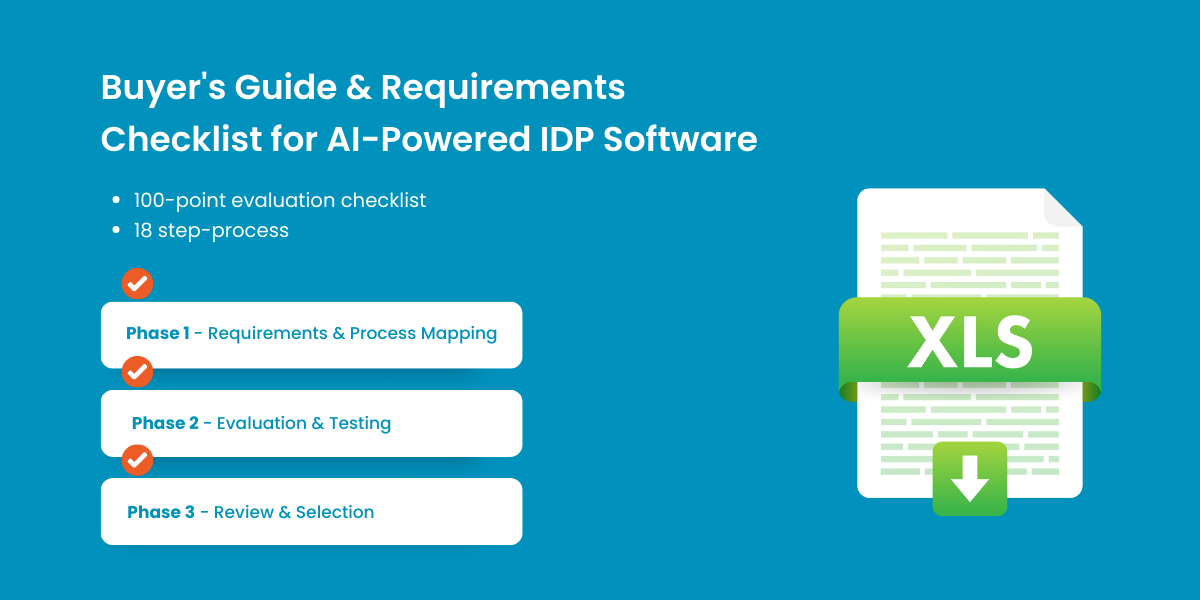

Related Content: Buyer's Guide & Evaluation Checklist for AI-Powered IDP Software

See it Live: Get a demo today