From Raw Data to Rich Insights: Harness Unstructured Data in Insurance

In the highly competitive P&C insurance sector, your ability to leverage data can be the difference between your company simply staying afloat and pushing ahead of the competition. Companies that want to stay ahead can never rest easy because data-related challenges continue to evolve, and today, one main challenge lies in processing and analyzing large volumes of data efficiently to inform decision-making and improve risk assessment.

New AI-powered tools offer promising approaches to processing and analyzing data, especially unstructured data in the most complex submissions, non-standard documents, and unexpected supplementary materials underwriters and other insurance personnel receive daily. This article explores how new “human-in-the-loop” approaches to AI use can help convert the tidal wave of unstructured data into concise, actionable information that underwriters can leverage for better decision-making.

What is unstructured data?

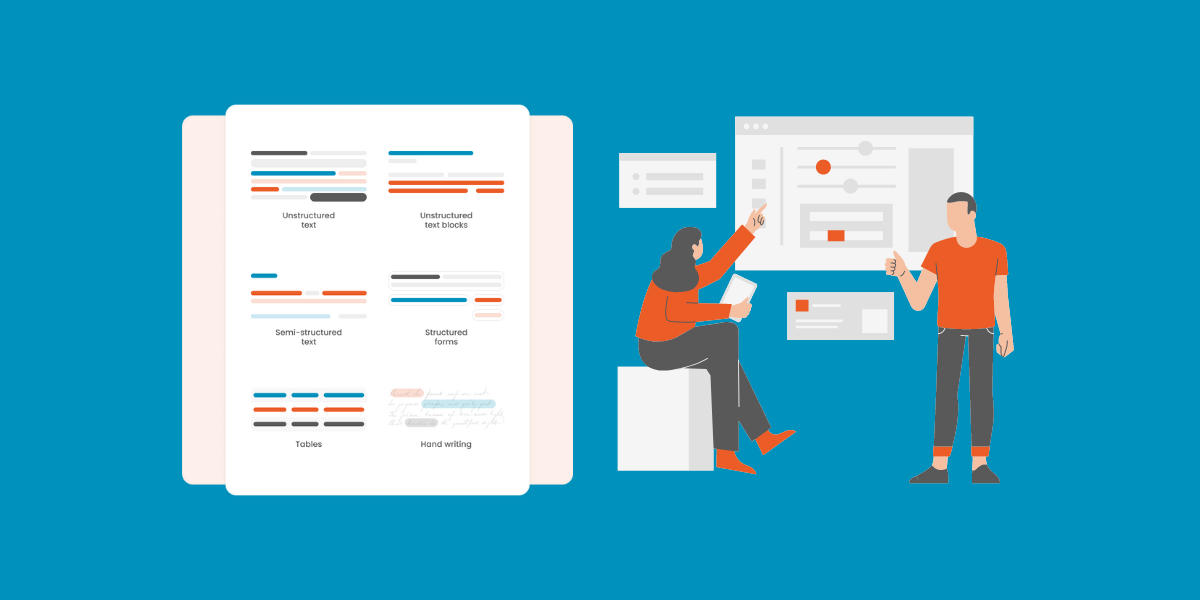

Unstructured data is any digital information lacking a formal structure that would be recognizable to traditional IT systems. Their unstructured nature makes it difficult for digital systems to recognize relevant information to extract automatically. In insurance underwriting, that frequently means text in freeform documents, emails, loss runs, statements of value, financial statements, or other scanned paper documents, including all types of handwritten forms.

In the past, handling unstructured data files meant relying on manual labor. That took a lot of time and often led to transcription errors. These problems could lower the quality of underwriting decisions and, therefore, potential profit margins and impact longer-term corporate strategy.

For insurance underwriters, efficiently interpreting and utilizing unstructured data can be a game-changer. It enables a more nuanced understanding of risk profiles, underwriting, and claims history, and customer behavior patterns. All of which can lead to more accurate and risk-appropriate decisions.

Different AI solutions work with different data types

Not all AI solutions are the same. Some were developed to work with highly structured documents. Those tend to offer high throughput on large volumes of data but only on a narrow range of well-structured document types. Think digital forms that brokers or clients fill out online and feed directly to an AI model that parses data into your management platform. Those AIs are good at their job but typically only good at that one job.

AI designed to work with unstructured data is much more adaptable but requires different degrees of training by human experts to make them work. A good AI-powered underwriting platform should be able to process low-complexity unstructured documents right out of the box—for example, ACORD forms.

But as we all know, the information clients log can be much more varied in much looser formats depending on the case. For example, pre-trained AI couldn’t make heads or tails of a Statement of Values (SOV) or a First Notice of Loss (FNOL) document, let alone attached emails included in underwriting submissions.

An untrained AI developed to work with unstructured data can extract some of the information you need from these documents but provides a much more comprehensive audit working with a human subject matter expert. More complex documents, like benefit proposals, Actual Production Histories (APHs), or Multi-peril crop insurance (MPCI) appraisals, typically require human-in-the-loop collaboration before underwriters see meaningful value.

How should insurance companies work with unstructured data?

If your commercial P&C underwriting team is considering AI tools for working with unstructured data, the first and most important thing you need to do is set expectations among your team members and other stakeholders.

Understand use cases and objectives

Start by identifying the outcomes your team is looking for. Are you trying to process a higher volume of submissions faster? Are you looking for new insights by capturing previously inaccessible data? Once you understand where you want to go, you can start looking for the right technology and supporting processes and more effectively solve for those outcomes.

For example, one SortSpoke client found their best business case was based not just on automation but also on finding value among submissions faster. “We're using a lot of predictive models to prioritize submissions and enhance the quality of the information we're getting,” the P&C manager for this Canadian insurer said. “I made the case for generating new efficiencies and an uptick in new business. With more efficient document processing, we’d be able to get to our profitable accounts a lot faster.”

Develop a Human in the Loop (HitL) approach

In commercial P&C insurance, fully replacing underwriters with automated AI solutions has yielded less than optimal results. To make final underwriting decisions, a human expert will utilize the data extracted by AI, contextual information, and industry knowledge. Unstructured data extraction tools can help, often ‘out of the box’ on some easy forms and document types. Still, a human-in-the-loop (HitL) approach will improve accuracy and maximize value.

Work with trainable AI

Increasing your team’s analytical capacity requires an AI solution that can handle various unstructured documents. Pre-trained templates can handle some simpler unstructured data sets but will not be able to handle the vast array of supplemental documents that brokers and clients typically include in underwriting submissions–for example, data in tables, handwriting, emails, and in different languages.

Use the right technologies for managing unstructured data

The introduction of emerging artificial intelligence technologies specifically designed to handle unstructured data is revolutionizing how insurers manage underwriting submissions, claims, and every other workflow that uses freeform data.

AI tools can analyze unstructured text, tables, and figures and extract data that can be processed and analyzed. This capability allows insurers to quickly assess risk, personalize policy offerings, and enhance the overall customer experience. For example, AI can review underwriting submissions and identify key information influencing decisions on whether to write policies. And since more data is collected, teams have a better digital “paper trail” to support their writing decisions if they come under review.

What about ChatGPT?

Can underwriters use ChatGPT? This is a question we hear regularly. ChatGPT is a “generative AI '' able to process and generate written and other forms of content. It does this thanks to its large language model (LLM) of layered neural networks that has been able to produce remarkably high-quality outputs.

But while ChatGPT can sometimes effectively summarize content you feed it, that has limited value to insurance companies. The main reason is that in insurance decisions, details matter. Most of the time, you don’t want to see a 10,000-foot summary of an underwriting submission. You want to extract every last detail from that submission accurately. Missing even one critical detail can mean the difference between a profitable and unprofitable portfolio.

Leverage your unstructured data by leveraging SortSpoke

Sortspoke is the premier platform for managing complex unstructured insurance data. It can manage simple unstructured data out of the box, and when paired with human experts, it can process documents up to five times faster than traditional methods. Our support extends to various formats, including MS Office files, images, tables, emails, PDFs, handwritten notes, and even password-protected documents, catering to a global clientele with capabilities in any language that utilizes the Latin alphabet.

These comprehensive data processing capabilities provide unmatched efficiency and support to underwriters. Through our innovative solutions, we're not just processing data. We're transforming the landscape of insurance underwriting for the better.

Book a risk-free, no-obligation call with our team to learn more.