Case Study: Great American Custom Insurance

Transforming Document Processing: 5x Efficiency Boost with SortSpoke

5X

40%

Same-Day

Customer & Use Case Overview

This client is a Fortune 500 insurance company.

350

Underwriters Processing Submissions

1,000

New Submissions Per Week

3,000+

Hours Spent on Manual Processing Every Week

TL:DR

Transforming Document Processing: 5X Efficiency Boost with SortSpoke

- Great American Insurance, a Fortune 500 insurance company, struggled with manual document processing across decentralized divisions

- 5X faster submission processing after implementing SortSpoke's AI-powered document extraction

- 40% increase in same-day quotes issued, driving higher revenue

- Unstructured data extraction enabled underwriters to maintain control while increasing efficiency

- Rapid adoption across multiple business units for various use cases beyond initial implementation

- Human-in-the-loop approach ensures 100% accuracy while reducing manual work

Customer Challenge

Decentralized Structure and Process Chaos

Manual document processing has always been a major headache for insurers like Great American Custom Insurance.

- The company was succeeding in the marketplace, but highly decentralized with dozens of divisions. Some were spun off from the original company, and others were acquired. To complicate matters, each division had a degree of autonomy in how they operated.

- Over time, that decentralized environment led to divergent business processes, especially around document intake, processing new accounts, and in underwriting – anything involving information technology. The AVP was responsible for identifying digital solutions where resources were limited.

- Manual entry was taking too many staffing resources and too much time.

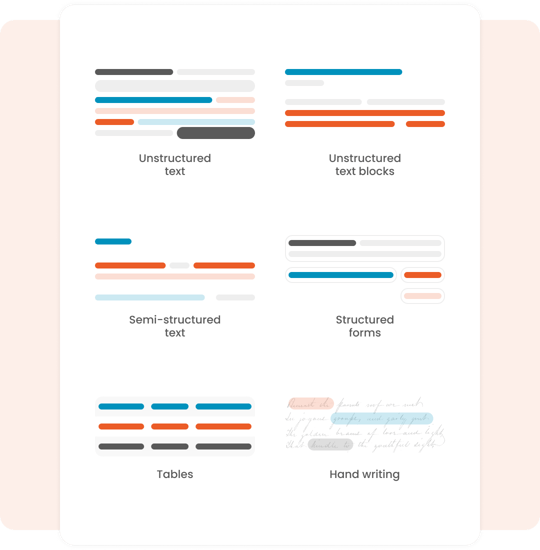

Document processing was a persistent pain point across divisions. Their greatest concern was the excessive manual labor needed from team members to process files, wrangle unstructured data and input information into their system.

The Solution

A Tool to Enhance Workflows Throughout The Underwriting Process, Without Removing Their Experts From The Process.

The AVP saw an opportunity to improve the underwriting process across divisions with AI-driven document management.

The team needed a reliable unstructured data collection and processing:

- With that the team could develop an enhanced user experience for their business units and others within the company.

- And insurance raters could easily prioritize reviews, make corrections and incorporate data.

The insurer was at a crossroads. If new federal regulations or precedent-setting legal suits were passed, there could suddenly be an emerging trend for a whole category of related lawsuits against this company’s clients.

The AVP realized this was the compelling business case she needed for streamlining their document processing. It was a business imperative – their risk assessment success depended on the quality of data collected and analyzed during underwriting.

Tired of Inefficient Underwriting Processes?

Process incoming submissions 5X faster than doing them manually with 100% accuracy with SortSpoke.

Results & Business Impact

Rapid Adoption and Clear Results with SortSpoke.

Team members were impressed with the SortSpoke-powered tools right away. The deployment was so successful that other business units within the insurance company soon asked the AVP for assistance deploying it for other use cases.

“We've been able to use SortSpoke for a variety of different types of work. Both short-term for analytics or looking at long-term integrated approaches, like extracting data specifically for analytics purposes,” she said

5X

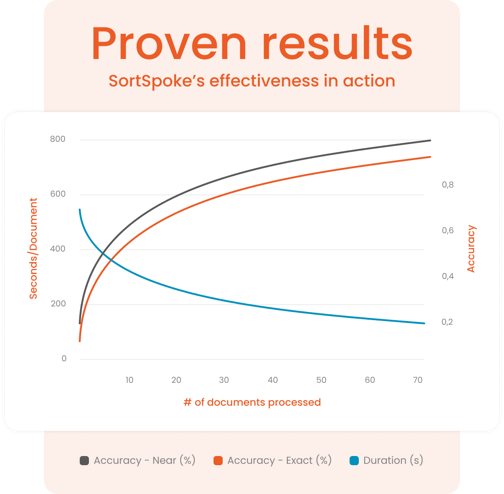

5x improvement in underwriting speed

40%

Quotes produced same-day increased by 40 percent

Adoption grew quickly after team members saw how easy it was to feed SortSpoke documents for processing and analysis.

The Fortune 500 insurance company is now seeing steady improvement in its underwriting, claims, and other processes. Their metrics show the intake process is four to five times faster per underwriting application, saving their team members valuable time. That has resulted in a 40 percent increase in written premiums.

The New Approach

Learn How To Boost Your Submission Processing By 2X

Process incoming submissions 5X faster than doing them manually with 100% accuracy with SortSpoke.

Transforming Document Processing: 5x Efficiency Boost with SortSpoke